Rooting through and indexing large amounts of documents can be a complex and time-consuming task, placing undue burdens on investigators and clogging a case’s workload. This sort of complication can have negative effects on the timeline and outcome of a case.

Enter Summation, an excellent multi-faceted software program used to keep documents organized so that nothing gets misplaced and provides many fields for indexing so that documents can be quickly retrieved when needed. It is utilized by many firms in the legal industry to manage document intensive cases. Like most software programs, however, there are many shortcuts available that users are often unaware of. These shortcuts can significantly increase productivity and efficiency when navigating within the program.

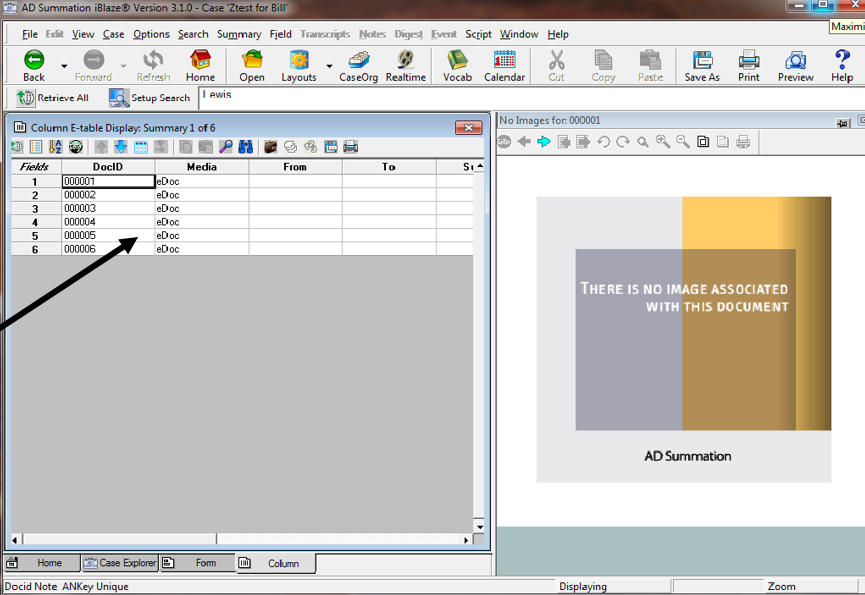

Below is a quick reference guide for some of the most frequently used keyboard shortcuts for Summation. The shortcuts vary based on which view you are using within the program. The “Column View” is where indexing takes place and below is a list of the shortcuts available that I find to be most helpful.

Column View

Ctrl + G = To quickly jump to a specific Summary

Ctrl + H = To Mark/Unmark a Summary as a Hot Fact

F2 = Toggle between Display/Edit Mode

F3 = Clear Current Field of All Contents

F4 = Input Today’s Date

F5 = Duplicate Field immediately above

F6 = Open Lookup Table

F7 = Go to Previous Record

F8 = Go to Next Record

F9 = Zoom

Shift + F4 = Retrieve All Summaries in Database

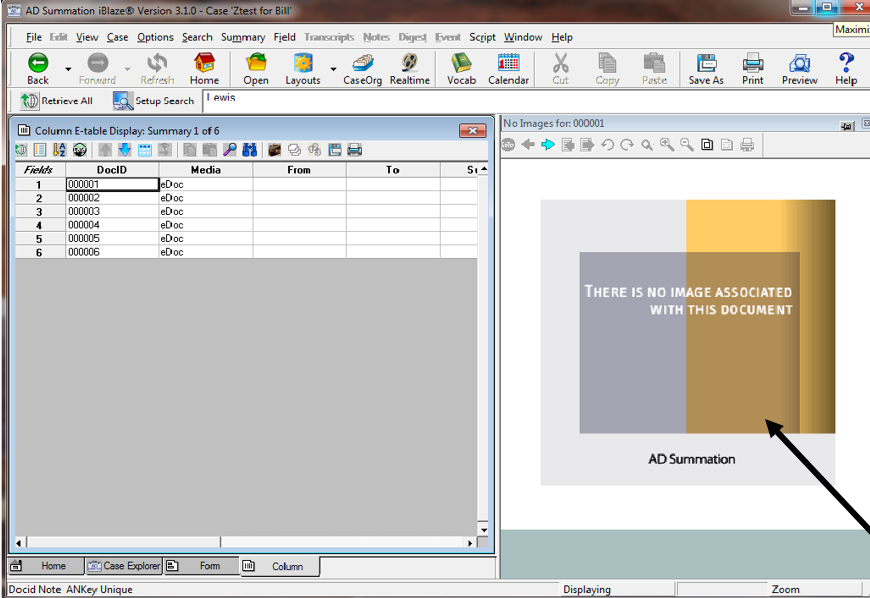

The “Image View” has many useful shortcuts available that can be used when navigating within the images themselves.

Image View

Ctrl + R = Print Current Page/Image

F = Fit Image in Window

F7 = Go to Previous Document

F8 = Go to Next Document

L = Rotate Document 90 Degrees Left

R = Rotate Document 90 Degrees Right

Minus sign (-) = Zoom out

Plus sign (+) = Zoom in

Page Down = Next page in a multi-page document

Page Up = Previous page in a multi-page document