The impact of COVID-19 on the value of private company interests is being actively explored and discussed nationwide by business valuation professionals, their professional trade associations, and users of business valuations (e.g. attorneys).

Because COVID-19 can materially impact the value of a private company, consideration must necessarily be given to the impact of COVID-19 on an active passive appreciation (APA) analysis in a divorce case. This post is the first in a series exploring and addressing the impact of COVID-19 on APA. While divorce cases include consideration of both business and non-business assets and liabilities, the focus of these posts will be on the business valuation in divorce cases involving the interests in private companies.

Given that COVID-19 continues to have an active impact on the U.S. and global economies and is dramatically affecting operations for public and private companies in some industries, consider these posts a work in progress and subject to revision as more information becomes available.

APA: A General Overview

An APA analysis is performed when state divorce law requires a determination of whether, and under what circumstances, value changes in a non-marital or separate business, occurring during a marriage or between the end of the marriage and the divorce trial, might be recharacterized in whole or part as marital property.

The business appraiser performing an APA analysis looks to their engaging legal counsel to define and interpret state law in the particular jurisdiction pertaining to APA, including any state-specific definitions of key terms (“marital property”, “non-marital property”, “separate property”, “divisible property”, etc.). Given the variety of APA-related terminology utilized in divorce statutes and case law of various jurisdictions, references in this and subsequent blog posts are intended to refer to general concepts typically found in an APA context, rather than try to cover all of the jurisdiction-specific definitions and nuances of terms. In these posts, general definitions are provided where necessary for clarity.

In practice, the non-marital or separate business interests (henceforth “Separate”) that are the subject of APA analyses are typically businesses already owned by one spouse prior to the marriage, or gifted or bequeathed to one of the spouses during the marriage

Whether changes in value of Separate businesses identified in an APA analysis are reclassified as marital property (henceforth “Marital”) is jurisdiction-specific and can depend upon factors including, but not limited to:

- The cause(s) of the value change; and,

- The timing of the value change:

- Whether any change in Separate business value occurred between the date of marriage (“DOM”) and the date of separation (“DOS” – in some jurisdictions called the Date of Filing); and,

- Whether any change in separate business value occurred after the DOS but before the date of distribution (“DOD” – in some jurisdictions also called the Date of Trial or “DOT”).

APA Overview – Active vs. Passive

Commonly recurring requirements in some jurisdictions are that value changes in Separate businesses can be reclassified as Marital based in part upon the cause(s) of the value change along with the timing of the value change, as follows:

- Separate business value changes between the DOM and DOS:

- Typically become Marital property to the extent they were caused by marital efforts or marital funds (often called “Active Efforts”).

- Typically remain Separate property to the extent they were caused by factors OTHER than marital efforts or marital funds (often called “Passive Factors”).

- Separate business value changes between the DOS and DOD:

- Typically remain Separate to the extent they were caused by Active Efforts.

- Typically become Marital to the extent they were caused by Passive Factors.

- Note that in such jurisdictions, a “flip” occurs depending upon whether the measurement period is between the DOM and DOS or between the DOS and DOD:

- Separate business value changes between the DOM and DOS caused by Active Efforts can be reclassified to Marital property;

- Separate business value changes caused by similar Active Efforts between the DOS and DOD often remain Separate property.

- State statute and/or case law sometimes explain this “flip” by referring to the concept that the period between the DOM and DOS is a period of an economic partnership in addition to being a marital partnership, but that the economic partnership ceases when the marital partnership ends (the DOS).

APA Overview – Hypothetical Illustration

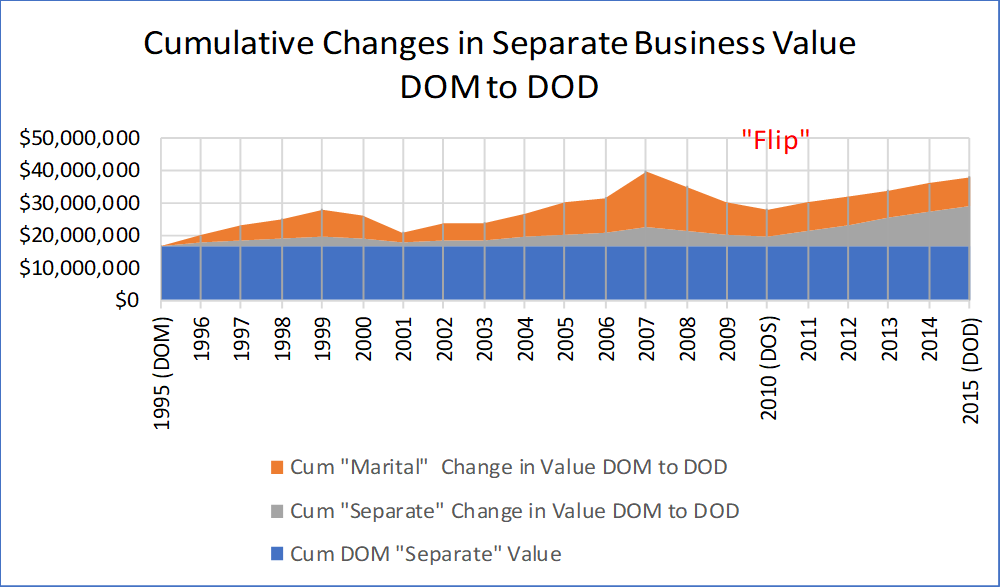

The following graph illustrates hypothetical changes in Separate business value between the DOM and DOD.

- The total business value is reflected by adding the blue, gray and orange areas on the graph. In this graph, the DOM business value is approximately $17 million, which increased to approximately $28 million at the DOS and approximately $38 million by the DOD.

- The blue area reflects the cumulative DOM value, which is unchanged during the period from the DOM through the DOD.

- Hypothetically assuming that active efforts by the owner spouse caused 75% of the value increase for the entire period from the DOM to the DOD, and that factors OTHER than active efforts by the owner spouse caused 25% of the value increase for the entire period from the DOM to the DOD:

- The gray area reflects the cumulative increase in the Separate business value that remains separate property.

- The orange area as of the DOS reflects the cumulative increase in the Separate business value between the DOM and the DOS that can be reclassified as marital property. Some jurisdictions characterize this amount as the part of the Separate business value increase in which the non-owner spouse gains an “equitable” Marital interest.

- The DOS is designated in the graph as the point at which the “flip” occurs:

- The gray area of the graph grows more rapidly than the orange area post DOS, since all of the Separate business value increase caused by the active efforts of the owner spouse post-DOS is allocated to Separate property. Increases in Separate business value post DOS caused by active efforts of the owner spouse remain Separate property.

- The orange area of the graph grows more slowly than the gray area post DOS, as only the allocated part of the post DOS business value increase caused by factors OTHER than active efforts is allocated to Marital property. Increases in business value post-DOS caused by efforts OTHER than the active efforts of the owner spouse can become Marital property.

Now that a foundation for APA analysis has been laid, our future blog posts will address incorporating the impact of COVID-19 in APA analyses.

If you are interested in more information regarding business valuation in divorce cases, how you can strengthen your case with a business valuation and active passive appreciation expert, or want to learn more about our services and our team, please contact us.