A do-it-yourself approach may work well for repairs around the house, but for CPAs conducting a financial statement audit, engaging specialized forensic accounting services to help design an audit to detect fraud can help avoid a career-damaging DIY disaster....

INSIGHTS

Home »

Forensic Technology: Harnessing The Power of Social Media in Fraud Investigations

Earlier this year, the U.S. Department of Justice charged eight Brooklyn, N.Y., men with fraudulently scamming more than $2 million out of COVID-19 relief programs. How did investigators track down the alleged scammers? Four of the accused men gave the...

In The Fight Against Embezzlement Fraud, Employers Should Trust — But Verify

Recently, the former comptroller of a Maryland dance academy pleaded guilty to fraud after she gambled away nearly $1.5 million of school funds at a local casino. One embezzlement fraud conviction is bad enough. But the woman in question had been convicted just eight...

Avoiding Accountant Malpractice Claims: It’s Not Getting Any Easier

For nearly 25 years now, I’ve been exhorting CPAs to take seriously their responsibility to detect fraud during an audit—or face the potentially ruinous financial and reputational consequences of accountant malpractice claims. Sadly, many audit firms and CPAs have yet...

Forensic Examinations: How Data Visualization Can Help Lawyers and Investigators Tell a Compelling Story

A forensic examination can yield a mountain of data from a variety of disparate sources that can help expose wrongdoing and provide hard evidence critical to proving (or disproving) a case. But gathering and analyzing the data is just one part of the task. What...

Another Year, Another Multi-Billion-Dollar Haul for the Government in False Claims Act Qui Tam Cases

The U.S. Department of Justice recently announced that it had collected $2.2 billion in settlements and judgments from civil cases involving fraud and false claims against the government during the last fiscal year — with the bulk of the money recovered via False...

The Guideline Transaction Method in Litigated Business Valuation: What Attorneys Should Consider

When reviewing a business valuation report, an attorney should check to see that the business appraiser considered the three approaches to value—market, income, and asset. While each approach has its own methodologies, our focus in this blog will be on the...

Financial Fraud Investigations: Bernie Madoff and the Art of Spotting Fraudsters

Written in collaboration with Janine Driver, author of You Can’t Lie to Me A few weeks ago, Bernie Madoff, architect of one of the largest and most infamous Ponzi schemes in history, died in prison. He was serving a 150-year term for swindling thousands of people to...

Investigating Employee Embezzlement: Understanding Organizational Risks and Responses

Discovering that a trusted employee has engaged in embezzlement fraud can lead to a series of sometimes contradictory responses by an organization’s leaders—actions that can harm an investigation and expose the enterprise to additional legal and financial risk....

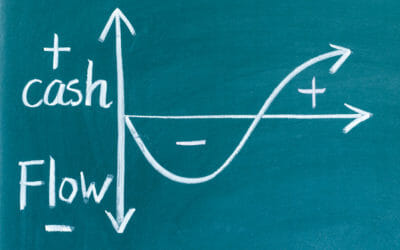

Business Valuation in a Divorce: Analyzing Cash Flow v. Net Income – Don’t Expect (or Give Away) What Doesn’t Exist

When a couple is divorcing in an equitable distribution or community property jurisdiction and their assets include ownership in a closely held company, the value of the business typically must be determined. Analyzing the company’s cashflow is imperative during such...

Calculating Economic Damages: It’s About Far More than the Math

Economic damages are designed to give claimants a chance to recover their financial positions in the wake of injuries caused by another party. Calculating those damages, however, is no easy task. Experts are required to help counsel and claimants build a credible...

Financial Fraud Investigations: Why an Employee’s Vacation is a Great Time to Detect Fraud

Time off isn’t just a necessity to help employees recover and regroup, it’s also an opportunity for an organization to measure its efficiency and to uncover vulnerabilities it may face from fraud, waste, and abuse. Here are just a few of the ways an organization can...