Welcome to the second and final part of our blog series on lack of control discounts and control premiums, two critically important issues when calculating the value of a company.

We tackled some of the fundamental questions attorneys may have regarding these concepts in our last post. (If you haven’t already, you can read it here.) As we discussed in part one, business appraisers usually rely upon a data resource, such as Mergerstat, to help them determine the value of a control premium or lack of control discount.

In this post, we consider the question: What option does an appraiser have if the control premium resources, like Mergerstat, contain no data related to the subject company or its industry?

Levels of Value Overview

As a reminder, a lack of control discount, is an amount subtracted from the marketable control value of shares because the shareholder lacks all or some of the powers of control over the company. Control premium refers to the price premium assigned to controlling shares of a company.

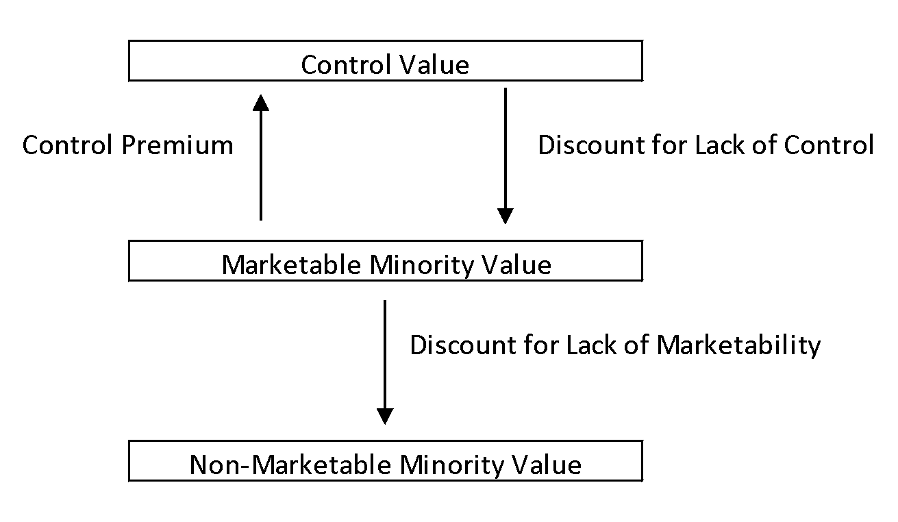

A company’s shares have levels of value. At the top is marketable control value, which includes shares with control over the business. These shares might be subject to a control premium. On the next level is marketable minority value, which is assigned to shares owned by minority shareholders who have no control over the company but who can easily sell their interests on a public stock exchange. These shares may be subject to a discount for lack of control. (The final level— the “non-marketable minority value”— includes minority shares which are not easily marketable on a stock-exchange and that may have restrictions on their sale.)

The following illustration provides a summary of the levels of value in business valuation.

Equity and Invested Capital Cash Flow

As we noted, the resource most widely used by business appraisers to obtain control premiums is Mergerstat, officially known as the FactSet Mergerstat/BVR Control Premium Study database through Business Valuation Resources, LLC. Updated weekly, the Mergerstat platform includes 20 years of data and more than 15,000 transactions. Despite the depth of this and other resources, an appraiser may not be able to locate data relevant to the subject company or its industry.

When data is absent or when the business appraiser simply wants to use an alternative to control premiums or discounts for lack of control, another approach is available to determine the control vs. minority value of the business. The appraiser can use cash flows to make their calculations.

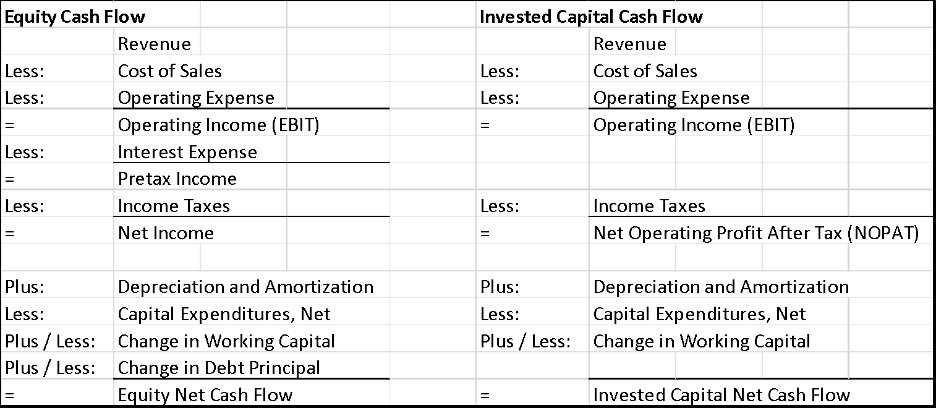

The table below illustrates the two types of cash flow—equity cash flow and invested capital cash flow— that may be used by a business appraiser to make their calculations.

Control or Minority Cash Flow

Cash flow can either be on a control basis or a minority basis, depending on what cash flow adjustments are made by the business appraiser.

In business valuation, control-based adjustments can include modifications to owner’s compensation, facility rental rates, or any items only a controlling shareholder could effectuate.

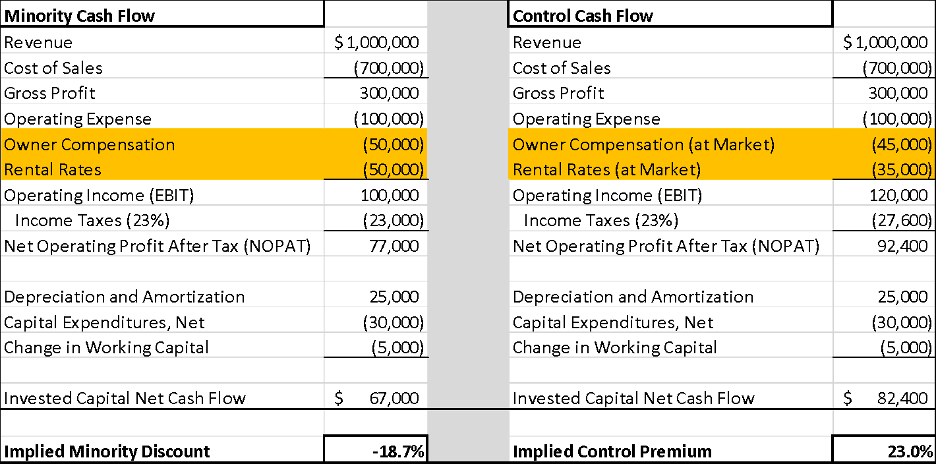

Alternative Approach

In this alternative approach, the difference in value between the application of control cash flows versus minority cash flows yields the implied discount for lack of control and conversely, the control premium. When control premium data is limited or unavailable, this alternative can be the most direct way to solve for the difference. Additionally, this alternative can be used as a reasonableness test even when control premium data is available.

Additional Thoughts

In certain cases, however, there is no difference between the control and minority cash flows. In these scenarios, a company has no “fat” to trim and the cash flows available to a controlling owner are equal to those of a minority owner. This is typical of much larger businesses with diversified operations that run efficiently due to sizeable management teams.

In other cases, generally in small, family-run businesses with related party transactions, costs can potentially increase on a control basis and therefore, reduce cash flow. Perhaps related party facility rental rates are below market and/or owner compensation is below market. Adjusting each of these to market rates of rent or compensation in the business valuation would result in increased costs and decreased cash flow. Hypothetically, these could lead to an initial unadjusted minority value that is greater than the control value. (This would be prior to marketability discounts, however, which is a topic for another day.)

This blog is designed to introduce some valuation theories and alternative considerations when attorneys encounter a business appraisal that includes either lack of control discounts or control premiums. Should you have any questions about these concepts or any other litigated business valuation topics, or if you would like to learn more about our services and team, please contact us.