Hiring a business valuation expert to provide an opinion on the value of your business can ensure that you and your legal counsel are equipped with the needed intelligence to make informed decisions at every stage of a dispute. But an opinion on a business’s value is...

INSIGHTS

Home »

Six Reasons Why You Should Be Sure to Include a Business Valuation Provision in a Prenuptial Agreement

No one on the verge of a wedding wants to think about the potential end of their marriage. But divorce rates remain high, and facing this reality with a prenuptial agreement can allow a couple to clearly define the financial terms of their relationship and save them...

Need Help with Your Case Strategy? A Business Valuation Expert Can Be a Critical—and Undisclosed—Asset

Business valuation professionals can play a high-profile and fully disclosed role in litigation, providing comprehensive conclusions about the value of an enterprise and testifying in court as an expert witness. But a business valuation professional’s role in a case...

How should the Value of my Business be Determined? Calculation of Value vs. Conclusion of Value

How a business appraiser determines the value of an enterprise may seem like a technical issue. But for business owners and their counsel, having a basic understanding of the approach suggested by a business appraiser —a calculation of value or a conclusion of...

Watch Out for ‘PBDS’: How Business Valuations Can Be Manipulated in Marital or Business Divorces

It’s not your imagination. In the periods just before a divorce or business ownership dispute, it’s so common for spouses and business owners to discover unexpected drops in reported profits, that I’ve coined the term “Pre-Dispute Business Downturn Syndrome” (or PBDS...

Understanding the Nuances of Business Valuation in Divorce Cases

A phased approach to business valuation in divorce cases can offer parties and their counsel strategic advantages and potential cost savings, as well. With a phased approach, divorce litigants and their counsel may determine how deep the business valuation process...

Phased Approach for Business Valuations to Serve Clients, Reduce Costs in Divorce Settlements

In divorce cases where the value of a company is in question, family law counsel are facing an increasingly common concern: How do they ascertain the value of the business in a way that provides the most accurate result for their clients—yet in the most cost-effective...

Bridging The Gap, Part II: What Attorneys Should Know About Lack of Control Discounts and Control Premiums in Business Valuations

Welcome to the second and final part of our blog series on lack of control discounts and control premiums, two critically important issues when calculating the value of a company. We tackled some of the fundamental questions attorneys may have regarding these concepts...

Bridging The Gap, Part I: What Attorneys Should Know About Lack of Control Discounts and Control Premiums in Business Valuations

When working with appraisers, attorneys are likely to grapple with questions about the relationship between two key business valuation concepts involving control exercised over a company. The first concept is the “lack of control discount,” which, in simple terms, is...

The Guideline Transaction Method in Litigated Business Valuation: What Attorneys Should Know About the Purchase Price

In my last blog post, I discussed the two types of transactions—stock and asset—that are found in the databases appraisers use when applying the guideline transaction method in litigated business valuation and how to use these transactions to determine value. In...

The Guideline Transaction Method in Litigated Business Valuation: What Attorneys Should Consider

When reviewing a business valuation report, an attorney should check to see that the business appraiser considered the three approaches to value—market, income, and asset. While each approach has its own methodologies, our focus in this blog will be on the...

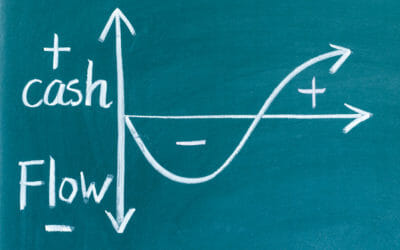

Business Valuation in a Divorce: Analyzing Cash Flow v. Net Income – Don’t Expect (or Give Away) What Doesn’t Exist

When a couple is divorcing in an equitable distribution or community property jurisdiction and their assets include ownership in a closely held company, the value of the business typically must be determined. Analyzing the company’s cashflow is imperative during such...